Photo Credits: Trevor Cole

OUR APPROACH

The Climate Finance Pathfinder (CFP) is a project supported by the Rockefeller Brothers Fund (RBF) that scopes the opportunity for low- and lower middle-income countries to access finance for their Nationally Determined Contributions (NDCs).

It consists of a mapping and analysis of each country’s climate finance landscape and provides specific initial recommendations based on this analysis on the steps countries may take to attract increased climate finance flows, especially of private and concessional finance.

The CFP process consists of three stages:

- Initial research and country scoping visit

- In-depth in-country assessment, including interviews with key stakeholders, and recommended approach; and

- Dissemination.

Pilots have been carried out in Ethiopia and Uganda, focusing on the agriculture and energy sectors, but the same approach could be applied to other countries and priority sectors.

The CFP approach is based on two key concepts or tools

- The ‘climate finance supply chain’ and

- Analysis of Barriers and Enablers

The climate finance supply chain

The CFP approach is based on the concept of the ‘climate finance supply chain’, built from experience and observation in a number of countries. For any country to be successful in mobilising climate finance at scale, this supply chain needs to work effectively.

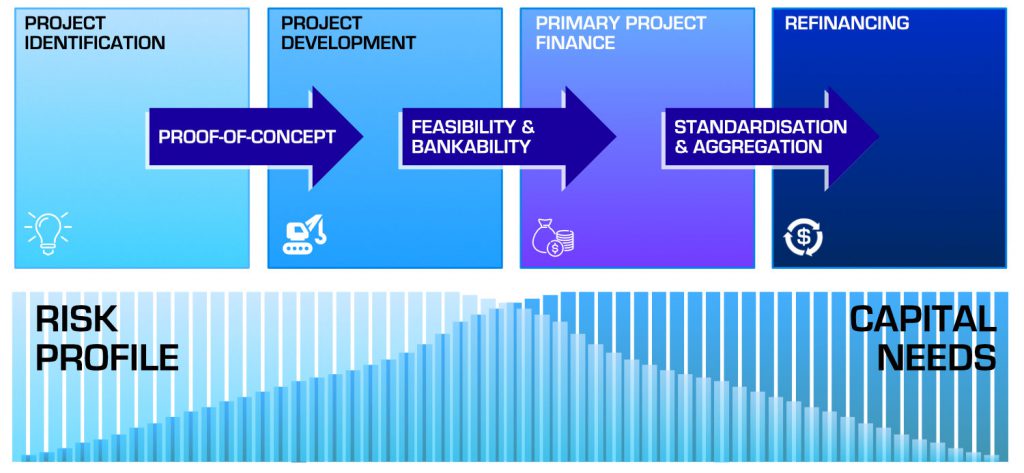

The chain typically has four main stages:

- Project origination—the identification of projects contributing to the implementation of a country NDC or low-carbon strategies

- Project development—to the state where a project can be considered for finance

- Primary project finance—ideally/typically in local markets; and

- Refinancing of projects (for projects with certain types of cashflow) via instruments such as green bonds, often raised on international capital markets.

The risk profile and capital needs of projects are inversely proportional as they proceed along the chain. Proof of concept will be required to move from project identification to development, feasibility, and bankability to primary project finance and standardisation and aggregation to facilitate refinancing.

Source: CFP team analysis

Barriers and enablers

Our research highlights a number of critical barriers to the access and mobilisation of increased levels of climate finance (in particular private capital). We have also highlighted actions which have or may enable increased flows of such finance in the future.

The barriers and enablers are sub-divided into the following five categories:

Policy and regulatory

Finance & Economics

Technology & Markets

Information & Capacity

Social, cultural, and behavioural

OUR PARTNERS